Capital increases are one of the key growth drivers for Swiss companies – over 4,000 are carried out every year. This article walks you through the process step by step: from financing simulation and shareholder resolution to notarial certification and commercial register filing. It highlights the legal complexity involved and shows how digitalization makes the process much faster and more efficient. With Konsento, companies can now complete a capital increase fully online – including meeting organization, investor commitments, automatic document generation, and remote notarization – saving up to 50 % in time and costs.

Introduction

Every year, around 4,000 to 5,000 capital increases take place in Switzerland. In 2022 alone, Swiss startups raised almost CHF 4 billion through capital increases. This corresponds to 383 financing rounds and represents only a small fraction of the total number of capital increases. Most of them are carried out by established SMEs that use the process to finance growth or strengthen their balance sheets. Although the number of financing rounds in Switzerland has steadily increased in recent years, 2023 may prove an exception due to the economic climate.

Capital increases are subject to strict legal provisions and are highly complex because of formal requirements. Notaries certify them and register them with the commercial register, carefully verifying that all legal formalities are properly observed.

To make this process more accessible, we offer here a general overview of the essential steps of a capital increase for entrepreneurs and board members.

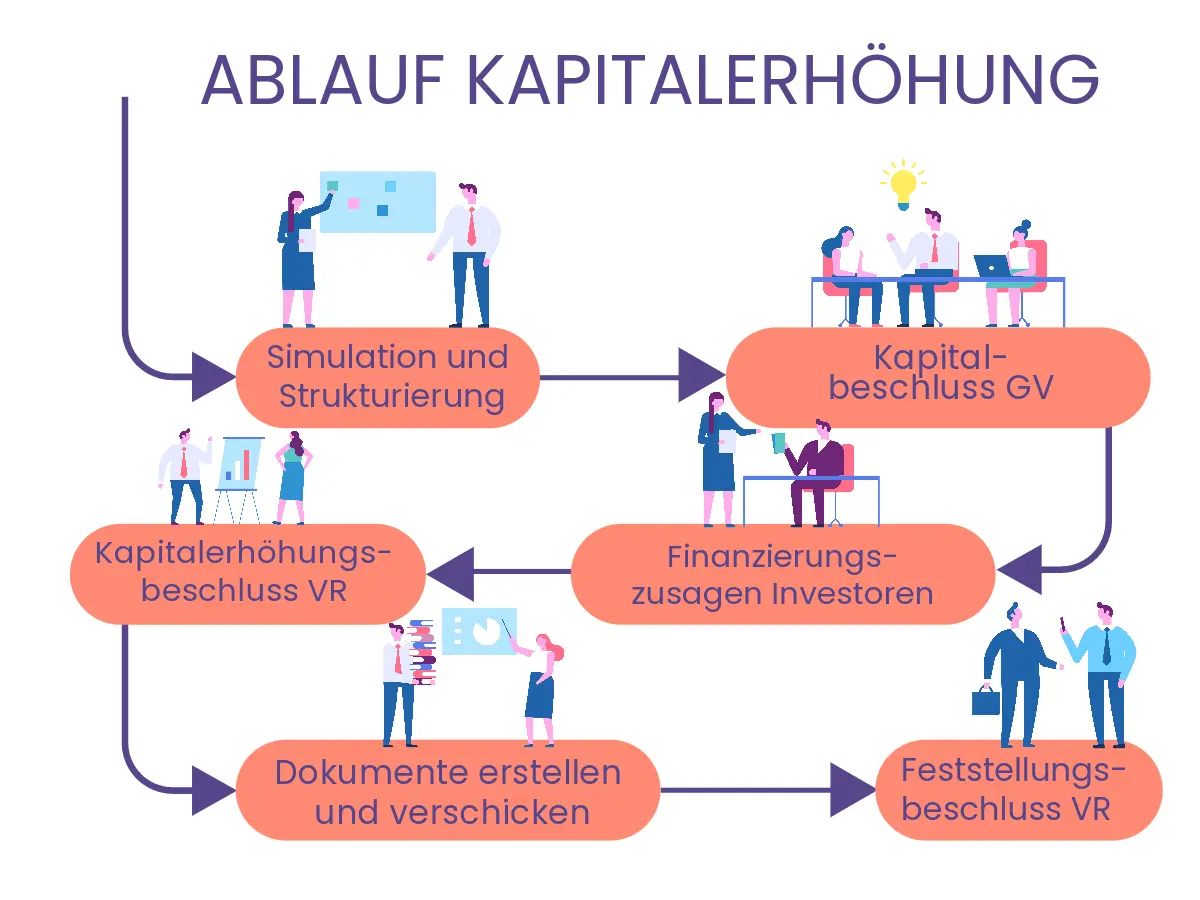

- Simulation and structuring: analysis of financing needs, company valuation, simulation of issue price, number of shares, and dilution.

- Shareholders’ resolution: shareholders approve the capital increase in an ordinary or extraordinary general meeting, notarized.

- Investor commitments: collection of financing commitments (“soft commitments”) with all relevant investor information.

- Board resolution: once sufficient commitments have been received, the board approves the capital increase and defines the details.

- Document preparation and submission: creation of all required documents for notarization and registration.

- Board confirmation and amendment of the articles: verification of the process, amendment of the articles of association, notarization, and filing with the commercial register.

Digitalization Can Simplify the Process

Digitalization can make the process much easier. Konsento offers tools for organizing meetings, templates for agenda items, electronic voting, automatically generated minutes, an investor portal for commitments, and the automatic generation of all documents required for notarization.

The entire process is significantly accelerated through digital workflows, reducing time and cost by up to 50 %.

Every year, between 4,000 and 5,000 capital increases take place in Switzerland. In 2022 alone, Swiss startups raised nearly CHF 4 billion through capital increases, representing 383 financing rounds – only a small portion of the total. Substantial amounts also flow to established SMEs to finance growth or restructure their balance sheets. Overall, the number of capital increases in Switzerland has steadily grown in recent years.

Capital increases follow legally prescribed rules and are highly complex due to strict formalities. Since they must be notarized and filed with the commercial register, compliance is meticulously verified. Thus, the common corporate-law saying “where there’s no plaintiff, there’s no judge” does not apply here.

To make the process more manageable for entrepreneurs and boards, the following section outlines the key steps of a capital increase.

The diversity of possible capital forms and the number of applicable rules exceed the scope of a single article, so we deliberately focus on the essential steps.

The Individual Steps of a Capital Increase

1. Simulation and Structuring

After determining capital needs, the process usually begins with analysing financing requirements and valuing the company. Based on this, the issue price, number of new shares, and dilution of existing shareholders can be simulated. These figures are refined through discussions with potential investors who bring their own perspectives to valuation. In practice, steps 1 and 2 may occur in reverse order.

2. Shareholders’ Resolution

Shareholders decide, at an ordinary or extraordinary general meeting (GM), to introduce an authorized capital band, conditional capital, or an ordinary capital increase. This decision must be notarized. If authorized or conditional capital is introduced, the articles must also be amended. The increase from authorized or conditional capital is legally limited to 50 % of the existing capital. Often, the exact funding requirements are not yet known, so maximum amounts are approved. In an ordinary capital increase, the GM decides to increase the capital by a specific or maximum amount, with no statutory limit.

3. Investor Commitments

Next, the financing commitments from investors are collected. This step, known in practice as a “soft commitment,” is central to the financing round. From a legal standpoint, it’s about obtaining all the required information about future shareholders to prepare the necessary documents. To conduct the legal process efficiently, more detailed data are required than just “Investor X will invest CHF 100,000.”

4. Board Resolution

Once sufficient commitments exist, the board – in the case of an authorized or previously approved capital – formally decides to increase the capital. Authorized capital increases are still possible until the end of 2024, depending on when they were introduced into the articles. For ordinary and conditional increases, a board resolution is not required.

Within the resolution, the board determines the nominal increase amount, par value, issue price, number and type of shares or participation certificates, any privileges or transfer restrictions, the start of dividend entitlement, and the type of contribution. It also records any limitation or cancellation of subscription rights. The resolution may be taken in writing or electronically but must be properly documented and signed by the chair and secretary, as it will later be presented to the notary.

5. Document Preparation and Distribution

Once the board has formally approved the capital increase and defined its details, the most administratively demanding phase begins: all relevant information must be accurately transferred into the documents required for notarization and registration.

These include, depending on the type of contribution, subscription forms, investor declarations, waiver statements, the capital-increase report and board declaration, amended articles of association, Lex Koller/Friedrich declarations, stamp-tax filings, audit reports, and the commercial-register application.

Depending on the company’s arrangements, shareholder or syndicate agreements may also be necessary. The bank managing the capital-deposit account must receive details of the contributing investors.

6. Board Confirmation and Amendment of Articles

After receiving the last payments, the board formally confirms that the capital increase has been properly executed. It verifies that all shares or participation certificates were validly subscribed, the contributions correspond to the issue prices, and all statutory and legal requirements have been met. The notary certifies that all relevant documents were presented and notarizes both the board resolution and the amended articles.

The capital increase is then filed with the commercial register. Only after registration is the deposited capital released by the bank.

Simplification Through Digitalization

The process shows that capital increases are complex transactions governed by strict formal rules. How well these are followed from the outset determines how quickly a company gains access to its paid-in capital.

Konsento has developed a structured digital workflow guiding companies through each step. It includes tools for organizing and recording general meetings and board sessions, templates for resolutions, electronic voting, automatic result counting, and automatically generated draft minutes.

Investors can access a secure portal to review the key details and documents of the financing round and provide their commitment. All necessary documents for the confirmation and registration are automatically generated and distributed. The final confirmation can even be notarized online via Konsento’s meeting module, and – if required – a licensed auditor can review the capital increase directly through the Konsento platform.

This unique and innovative process significantly reduces turnaround time and external costs by up to 50 %.

Sign up for our newsletter to stay up to date on business administration.

Or follow us on social media: