The Transparency Act requires Swiss companies to identify and report their beneficial owners (UBO) for the first time. This article explains when someone qualifies as a beneficial owner, how direct and indirect control is determined, and why contractual influence rights and acting in concert also play a central role. Early clarification of ownership structures helps avoid time pressure and compliance risks.

Introduction

With the Transparency Act, Switzerland is introducing a central transparency register for the first time. At the heart of the new regulation is the obligation for companies to identify, document, and report their beneficial owners -- also known as Ultimate Beneficial Owners (UBO) -- to the transparency register within the prescribed deadlines.

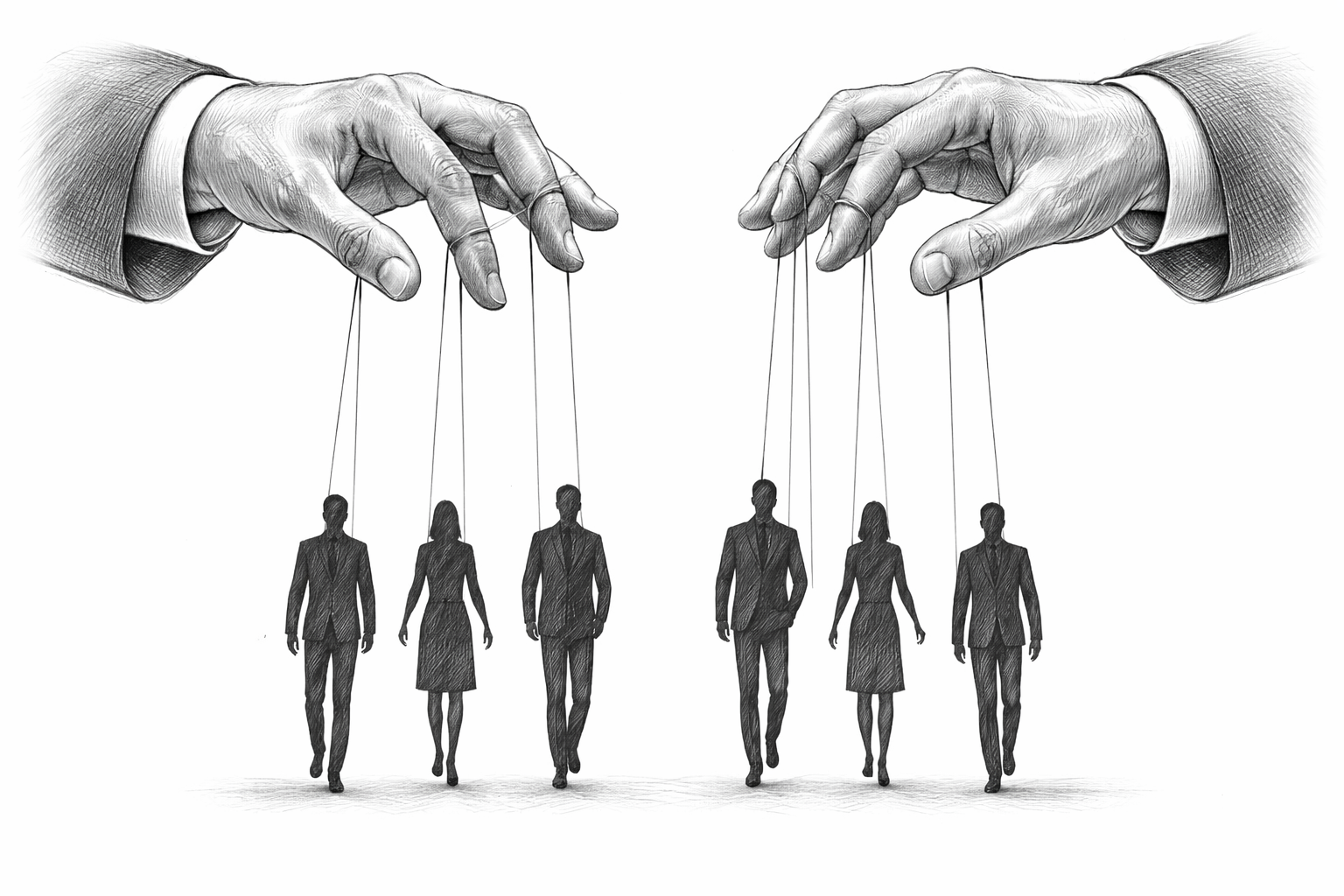

What sounds straightforward at first glance can prove quite tricky in practice. The concept of beneficial ownership goes far beyond the mere shareholder. In addition to direct holdings, indirect ownership chains, contractual influence rights, and joint action play a central role. This article explains what constitutes a beneficial owner, how control is determined, and why companies should address their ownership structure early on.

Table of Contents

- What is a beneficial owner?

- Direct and indirect control under the Transparency Act

- Control by other means -- when influence matters more than capital

- Acting in concert and UBO groups

- Special cases and subsidiary solutions

- Conclusion: Why early clarification pays off

What is a Beneficial Owner?

A beneficial owner is any natural person who ultimately controls a company -- whether directly, indirectly, alone, or together with others (Art. 4 para. 1 ATLE). The beneficial owner does not necessarily have to be identical to the legal owner of the shares.

The legislator deliberately focuses on actual influence. What matters is therefore not only who owns the shares, but who can actually determine how key decisions are made. This definition largely corresponds to that of the Anti-Money Laundering Act and international standards (Art. 4 ATLE).

Direct and Indirect Control Under the Transparency Act

A beneficial owner first exists when a natural person holds at least 25% of the capital or voting rights of a company (Art. 4 para. 1 ATLE). The relevant capital is that registered in the commercial register, including participation capital. Rights such as conversion or option rights are not taken into account in the pure shareholding calculation (Art. 4 ATLE; Art. 2 OTLE).

However, ownership relationships are often more complex. The Transparency Act therefore expressly covers indirect control as well. Such control exists when a natural person controls more than 50% of one or more intermediate companies that in turn hold at least 25% in the target company (Art. 2 para. 2 and 3 OTLE).

This indirect control can occur through classic ownership chains, but also through multiple holdings held in parallel. In practice, this means that ownership structures must be analyzed across multiple levels -- regardless of whether the intermediate companies are located in Switzerland or abroad.

Control by Other Means -- When Influence Matters More Than Capital

Not all control can be expressed in percentages. The Transparency Act therefore recognizes control by other means, which can exist independently of a holding of 25% or more (Art. 4 para. 1 ATLE; Art. 3 OTLE).

Such control exists in particular when a person can exercise decisive influence over the company, for example through:

- the right to appoint the majority of the board of directors,

- veto rights on key decisions,

- decision-making rights over profit distribution,

- dominant influence based on shareholders' agreements, fiduciary relationships, or special financing instruments.

It is important to note that the examination does not only take place when there is no 25% holding. Control through shareholding and control by other means must be assessed in parallel (Art. 3 OTLE). Particularly in family-owned businesses or startups with investor rights, this form of control is often relevant in practice.

Acting in Concert and UBO Groups

The Transparency Act clarifies that a beneficial owner can also control a company in concert with third parties (Art. 4 para. 1 ATLE). Art. 5 OTLE specifies this joint action and draws on the proven practice of stock exchange law.

Acting in concert refers to situations where multiple persons coordinate their behavior with regard to acquiring a holding, exercising voting rights, or another form of control -- whether through a formal contract or through informal but organized procedures (Art. 5 OTLE). The coordination between the persons concerned does not necessarily have to be formalized in the form of a shareholders' agreement. Informal coordination can also be relevant if it enables multiple persons to exercise their voting rights in a coordinated manner.

Typical examples include:

- shareholder groups with coordinated exercise of voting rights,

- simple partnerships such as investor syndicates that jointly hold shares in the target company,

- communities of heirs who collectively exercise their rights.

In such cases, all persons involved are considered beneficial owners, even if their individual share is below 25% in each case. The transparency register thus deliberately covers collective forms of control.

Special Cases and Subsidiary Solutions

Special rules apply to certain legal forms. In the case of a SICAV, only entrepreneurial shareholders can be beneficial owners; investor shareholders are not considered UBOs as they do not exercise control (Art. 5 ATLE).

If, despite careful examination, no beneficial owner can be identified -- for example in the case of widely dispersed shareholdings -- a subsidiary rule applies: the most senior member of the executive body is then considered the beneficial owner, such as the chair of the board of directors (Art. 4 para. 2 ATLE). This solution primarily serves to ensure contact with authorities and does not mean that this person actually exercises economic control.

Conclusion: Why Early Clarification Pays Off

Identifying the beneficial owner is rarely a purely formal exercise. Depending on the ownership and control structure, complex clarification and documentation obligations may fall on the company even before a report to the transparency register is possible.

Precisely because the Transparency Act provides for short implementation deadlines depending on the legal form and size of the company, it is worthwhile to begin analyzing the ownership structure today. Those who clarify their shareholder and control relationships early avoid time pressure, supplementary reports, and unnecessary risks.

The good news: this preparation is already possible today. With Konsento's free digital share register, companies can properly record their ownership structure and beneficial owners and optimally prepare for the future report to the transparency register.