A subsequent contribution on partially paid-in shares strengthens a company’s capital structure, mitigates legal risks and enhances financing capacity. This article outlines when a subsequent contribution is advisable, the legal steps involved and why completing the contribution is crucial for governance and investor readiness.

Introduction

When incorporating a Swiss company limited by shares (AG), at least 20% of the nominal value of each share must be paid in, and a minimum total of CHF 50,000 is required – even if the share capital is denominated in a foreign currency (in that case, the exchange value at the time of incorporation applies).

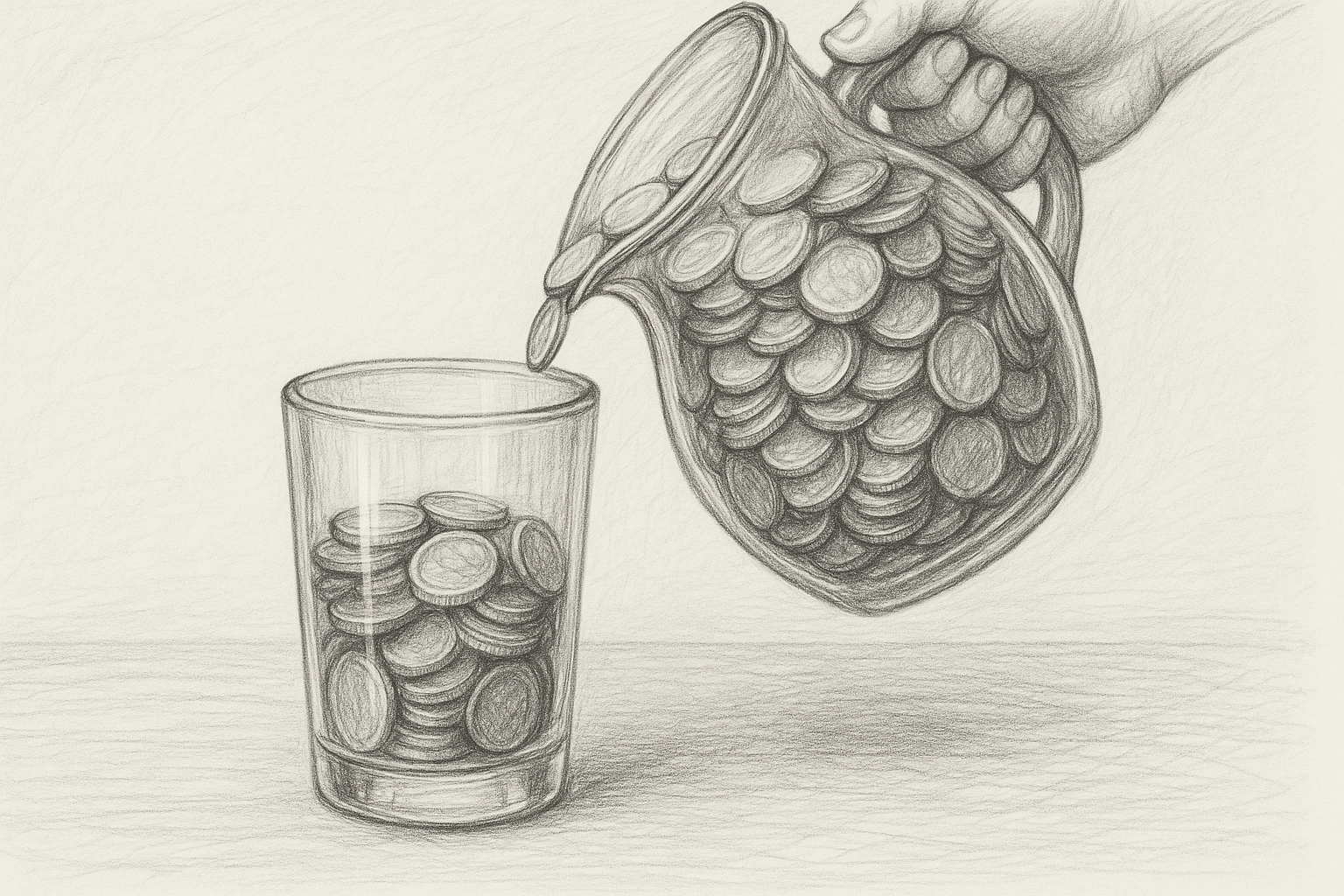

The unpaid portion – i.e. the difference between the statutory share capital and the capital actually paid in – remains owed by the shareholders.

Partial contributions may offer financial flexibility at incorporation, but they also carry significant legal and economic risks.

Shareholders who do not fully pay up their shares are exposed to a latent payment obligation and restrict the company’s ability to act or raise capital.

The board of directors may request the subsequent contribution (Art. 634b para. 1 CO) at any time.

If a shareholder fails to comply, they may face default interest, exclusion from shareholder status (forfeiture), or even a complete loss of their rights.

Moreover, a partially paid-up capital is viewed negatively by investors.

Companies presenting partially paid-in shares in financing rounds signal an incomplete capital base.

Even if the obligation to pay the outstanding amount clearly lies with the current shareholder, it raises doubts about the actual financial strength of the company.

Selling such shares is also risky: once the buyer is entered in the share register, the obligation to pay the remaining contribution generally passes to them.

However, under certain conditions – especially in the event of bankruptcy within two years – liability may remain with the original subscriber.

For these reasons, it is strongly recommended to resolve partial liberations as soon as possible.

The subsequent contribution offers a clear, legally regulated process to do so.

Table of Contents

- When is a subsequent contribution advisable?

- Step-by-step procedure for the subsequent contribution

- Practical guidance for implementation

- How Konsento digitises and simplifies the process

When is a subsequent contribution advisable?

At incorporation, the founders may have resolved on a statutory share capital (e.g. CHF 100,000) but only partially paid it in (e.g. CHF 50,000).

They thus owe the remaining CHF 50,000 to the company.

A subsequent contribution consolidates the legal and financial structure of the company, removes personal payment obligations of shareholders, and creates clarity for future transactions or financing rounds.

Startups with growth ambitions especially benefit from paying up their shares in full before raising capital.

A clean capital structure is also a significant advantage when planning for an exit or succession.

Step-by-step procedure for the subsequent contribution

The subsequent contribution is not a capital increase. It is the fulfilment of the capital contribution agreed at the time of incorporation.

Therefore, the board of directors – not the shareholders’ meeting – is responsible for approving the contribution (Art. 634b para. 1 CO).

The process follows five clearly defined steps:

1. Payment of the outstanding amount into a blocked capital contribution account

The board opens a blocked account with a Swiss bank.

Shareholders of the affected, partially paid-in shares transfer their remaining contributions to this account.

The bank issues a formal confirmation of payment, which is submitted to the notary later.

2. Board resolution confirming the subsequent contribution

Once payment has been received, the board of directors adopts a resolution confirming that the subsequent contribution has been made in full in favour of the blocked account.

This resolution can also be adopted via written circular or online board meeting.

3. Amendment of the articles of association

In companies with partially paid-in shares, the articles of association typically include a clause such as “The shares are 50% paid-in.”

Following the contribution, this clause must be amended to reflect that the share capital is now fully paid up.

Although article amendments are generally approved by the shareholders’ meeting (Art. 698 para. 2 no. 1 CO), amendments in the context of capital increases or subsequent contributions can be made by the board of directors.

No general meeting is required.

4. Notarial public authentication

The resolution and the amended articles must be notarised (Art. 647 CO).

This notarisation is mandatory for submission to the Commercial Register (Art. 54 Commercial Register Ordinance).

The notary will verify the bank confirmation and the revised articles.

5. Filing with the Commercial Register

The board submits the notarised deed, the bank confirmation and the revised articles for registration.

Only after the Commercial Register entry is complete can the capital be released and transferred to the company’s business account.

Practical guidance for implementation

The administrative effort is manageable as long as the formal requirements are strictly followed.

Clear coordination between the board of directors, the contributing shareholders, the notary and the bank is crucial.

Special care must be taken in drafting resolutions and amendments to the articles.

Errors may delay registration – and block access to the capital.

How Konsento digitises and simplifies the process

With Konsento, the board of directors can prepare and pass the subsequent contribution entirely online.

All documents required for notarial certification and registration with the Commercial Register are generated automatically.

The notary completes the authentication online – without any physical meeting.

This makes the entire process efficient, secure and legally compliant – no matter where your company is based.

The subsequent contribution becomes a standard, reliable corporate action.

Carry out the subsequent contribution now.

Do you want to fully pay up your shares and are looking for a simple, legally compliant solution for the subsequent contribution? Register your company on Konsento for free. Registered users can initiate the process directly from their dashboard.